What We Do

GlobalAgRisk is equally committed to advancing concepts, testing them in practice, and sharing new knowledge in peer reviewed journals and outreach publications. Our reputation has inspired the confidence of a number of prestigious philanthropic organizations to entrust us with resources, including the Bill and Melinda Gates Foundation and the Ford Foundation, among others.

FROM CONCEPTS TO PRACTICE AND BACK

Our ideas are vetted in academic journals and then tested with real world applications. Since 2001, GlobalAgRisk has produced over 100 papers, research reports, and other documents. Visit our library page to see our publications.

GlobalAgRisk implements a number of field based activities throughout the World. Visit our Projects page for more information.

SOFTWARE DEVELOPMENT

Over the years, GlobalAgRisk has developed various software that can be used for Financial Disaster Risk Management Solutions. A recent example is some proprietary software that can be used to evaluate blending risk capital for global entities seeking to find unique solutions to manage disaster risk. By using science to structure ex-ante financing, global entities (humanitarian organizations, agribusinesses, fund managers making investments in low and middle-income countries, networks of microfinance institutions, etc.) can make decisions about how to manage disaster risk using reserves, access to loans, and insurance.

EDUCATION AND CAPACITY BUILDING

GlobalAgRisk maintains an active educational outreach program as part of its mission. For example, as part of a project in Peru that seeks to lower barriers to financial inclusiveness in the El Niño exposed North, GlobalAgRisk developed the EENIP Financial Model and accompanying Handbook. This project increased the capacity of these MFIs to assess and model their exposure, thus contributing to a more proactive management of natural disaster risk by MFIs serving the poor in Peru. Educational efforts are always a key component of our product design and pilot implementation processes, ensuring that stakeholders understand the new products and their concerns are addressed.

CONCEPTUAL FOUNDATIONS OF OUR BUSINESS MODEL

Access to financial services in lower income countries is seen as a key factor to keep people from falling into chronic poverty, and over the longer term, to help people rise out of chronic poverty. Catastrophic weather risks create serious constraints to the development of credit, savings, and insurance services for rural households. Because catastrophic events can create widespread losses, local banks and insurers are simply unable to pool and manage these extreme risks on their own.

Two key constraints must be addressed to make catastrophic weather risk products sustainable. First, catastrophic weather risk must be transferred out of the vulnerable community and region, ideally by using the international reinsurance market which manages major risks throughout the world. Second, the risk transfer process must be efficient and affordable, since high transaction costs impede the development of insurance markets in lower income countries. GlobalAgRisk focuses on developing innovative risk transfer mechanisms to address both constraints, creating opportunities for more complete financial markets.

INDEX INSURANCE

Index-based (also referred to as parametric) insurance can offer a starting point for financial risk management in countries where traditional mechanisms are not feasible. Index insurance uses a third-party measure that is related to consequential losses and extra costs to make payments. This third-party measure can be as direct as a measure of rainfall (too little or too much), a level of water in a river, sea surface temperature, or modeled results that estimate the intensity of an earthquake.

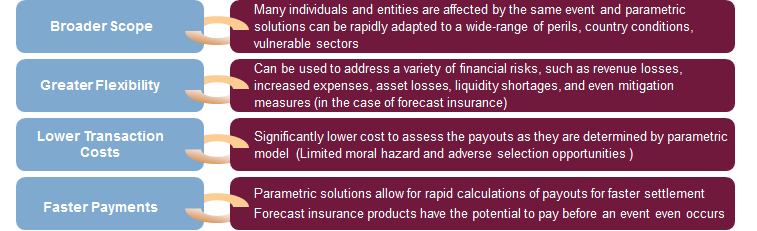

Index insurance has many advantages over traditional indemnity products (see figure below). What makes such products particularly suitable for new markets is that they can be developed more quickly to get the “big risk” out of the way. This provides a foundation for innovations that can follow which include more traditional approaches to insurance. Catastrophic El Nino, for example, is a major obstacle in developing agricultural insurance in Peru. Every past attempt to introduce commercially viable traditional product has been foiled by unsustainable losses in the wake of devastating flooding caused by major El Nino events. Thus, removing this big risk is the first step to jump starting a viable market for more conventional insurance products. GlobalAgRisk has introduced a special form of index insurance against extreme El Nino in Peru, known as forecast insurance.

Advantages of Index Insurance over Traditional Insurance: