IDB Conference on Risk Management in Agricultural Finance: Building More Inclusive and Secure Markets

The September 24, 2012 Inter-American Development Bank conference on Risk Management in Agricultural Finance examined new approaches for managing agricultural risks that help expand access to finance while lowering rural poverty and improving food security in Latin America and the Caribbean. The focus was on market-based approaches that address pervasive price and output risks in agriculture. Experts discussed the challenge facing policymakers and practitioners as they seek successful innovations that are sustainable and scalable. The conference highlighted case studies of products and institutions that are considered to be at the cutting edge and have already demonstrated effective results.

The September 24, 2012 Inter-American Development Bank conference on Risk Management in Agricultural Finance examined new approaches for managing agricultural risks that help expand access to finance while lowering rural poverty and improving food security in Latin America and the Caribbean. The focus was on market-based approaches that address pervasive price and output risks in agriculture. Experts discussed the challenge facing policymakers and practitioners as they seek successful innovations that are sustainable and scalable. The conference highlighted case studies of products and institutions that are considered to be at the cutting edge and have already demonstrated effective results.

Dr. Jerry Skees presented on Creating a Regional Platform for Risk Management in LAC. Viewed form the regional perspective, there are many opportunities to diversify and transfer risks. The approach proposed is for a market based facility to manage regional risks through use of reserves, access to contingent credit, futures exchange markets, and recent innovations in risk pooling for natural disasters. Economies of scale and scope are needed for a Regional Platform to be effective with adequate capitalization and a capacity to manage a diverse portfolio of risks.

Click here to download the presentation.

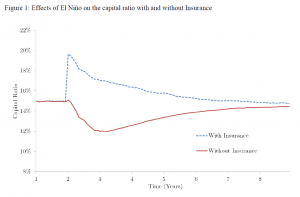

Benjamin collier presented on Financial Inclusion and Pro tecting Bank Portfolios from Natural Disaster Risks. Sustainable financial inclusion is significantly challenged by the presence of systemic risks such as natural disasters and commodity price volatility. In general, financial institutions are poorly equipped to manage these systemic risks under current public and private sector standards. Systemic events create losses, erode capital and compromise their ability to lend. As a result, financial institutions limit their financing for vulnerable households and firms. Portfolio-level insurance against disasters can improve management of these events. The case of insurance against exposure to severe El Niño effects in Peru will be presented, showing how this product allows lenders to manage this risk more efficiently and effectively, translating into better financial performance, expansion of banking service outreach, lower interest rates, and reduced volatility in access to credit.

tecting Bank Portfolios from Natural Disaster Risks. Sustainable financial inclusion is significantly challenged by the presence of systemic risks such as natural disasters and commodity price volatility. In general, financial institutions are poorly equipped to manage these systemic risks under current public and private sector standards. Systemic events create losses, erode capital and compromise their ability to lend. As a result, financial institutions limit their financing for vulnerable households and firms. Portfolio-level insurance against disasters can improve management of these events. The case of insurance against exposure to severe El Niño effects in Peru will be presented, showing how this product allows lenders to manage this risk more efficiently and effectively, translating into better financial performance, expansion of banking service outreach, lower interest rates, and reduced volatility in access to credit.

Click here to download the presentation.

Richard Carpenter presented on Barriers to Product and Institutional Innovations. What is the appropriate legal and regulatory setting to support new innovations in insurance and derivatives? What are the needed upgrades to banking regulation and supervision? Based on experiences in various countries, the presentation identifies what are the main “gaps” found in emerging market economies that inhibit the use of state-of-the-art financial instruments. Also discussed are lessons regarding how to overcome these barriers.

Click here to download the presentation.

Continue Reading | Comments Off on IDB Conference on Risk Management in Agricultural Finance: Building More Inclusive and Secure Markets

Enhancing Financial Services through Portfolio-Level Disaster Insurance

.

Continue Reading | Comments Off on Enhancing Financial Services through Portfolio-Level Disaster Insurance

MicroInsurance Innovation Facility Interview

Dr. Skees was recently interviewed by the ILO MicroInsurance Innovation Facility in Geneva, Switzerland where he also provided a workshop to the Facility’s staff.

Continue Reading | Comments Off on MicroInsurance Innovation Facility Interview