Posts Tagged ‘lower income countries’

How can Innovation in Risk Transfer Reach the most Vulnerable?

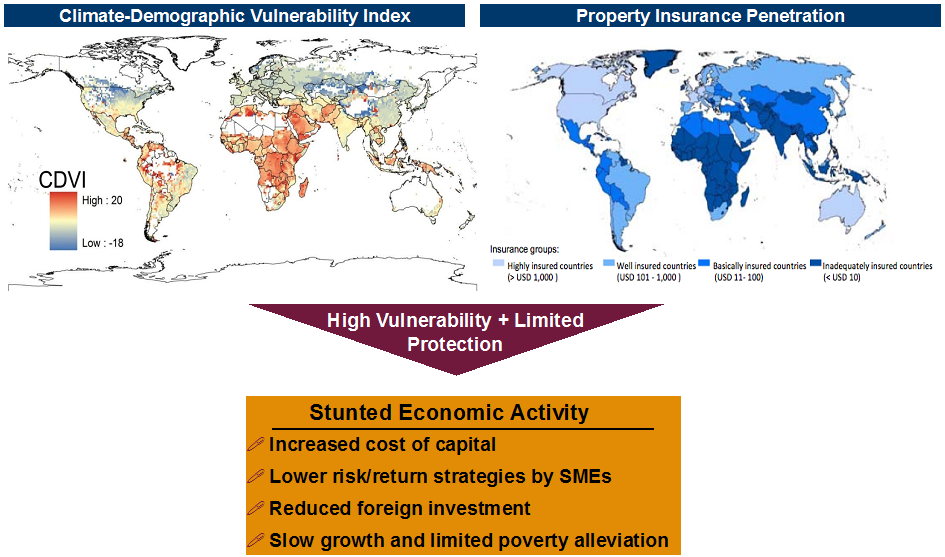

The typhoon-ravaged Philippines are a powerful reminder of the high toll of disaster risk. Vulnerability to climate shocks and natural disasters in general continues to grow, particularly among the least equipped to withstand and rebound from this risk. The graphic below paints a telling picture. The first map is a Climate Demography Vulnerability Index (CDVI), developed by Sampson, et al. (2011); the second gives an overview of property insurance penetration. High vulnerability plus the lack of financial protection means even slower economic growth and more poverty in the future.

The good news is we have the technological and scientific wherewithal to model disaster risks which can significantly improve capacity to manage them. For example, the UK Met Office uses more than 10 million weather observations a day, an advanced atmospheric model and a high performance supercomputer to create some of the world’s most accurate forecasts. These forecasts can be used to model climate risks in Africa, Asia, South America and other regions where traditional insurance markets have failed to flourish. Climate models, in turn, can feed into the design of potent financial disaster risk management products.

We have capacity in the international risk markets to hold this growing risk. For example, the reinsurance industry capital now stands at USD 510 billion. According to Aon Benfield, insurers and reinsurers will benefit from additional USD 100 billion of alternative capital in the next five years.

Lastly, we have the goodwill to find working solutions. Development organizations have entrusted millions of dollars with practitioners, such as us, to test the potential of financial innovation in fighting poverty and building resilience at scale. The parts are there. How can we unlock this existing potential to deepen risk transfer markets in lower income countries?

Continue Reading | Comments Off on How can Innovation in Risk Transfer Reach the most Vulnerable?