Posts Tagged ‘climate resiliency’

Why Is Financial Protection Important And Why Is It Not Reaching Lower Income Countries?

Super Typhoon Haiyan satellite image.

Droughts, floods, heat waves, and tropical cyclones are on the rise. According to the UK Met Office, climate related hazards affected over 220 million people on average every year in the period 2000-2009. Extreme events destroy livelihoods and undermine the capacity of communities to adapt to even moderate shocks.

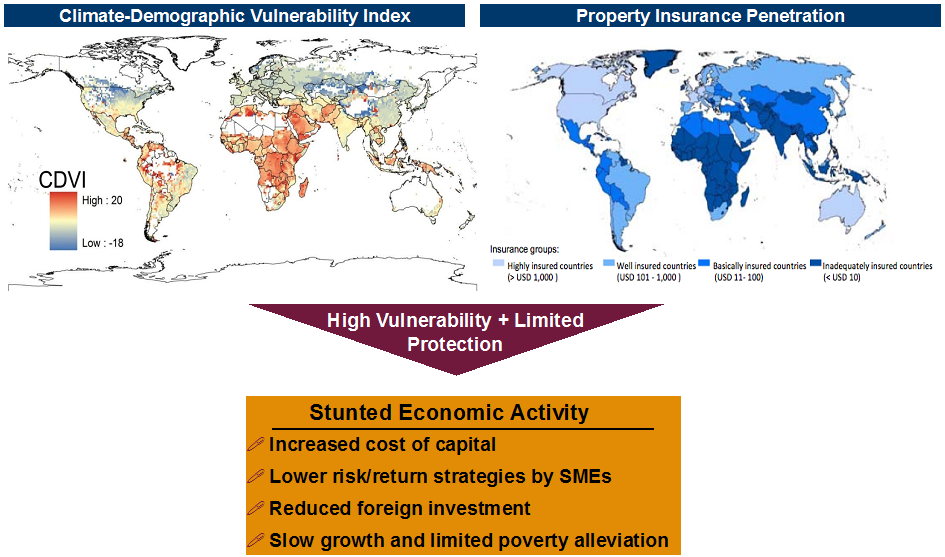

Financial disaster risk management (FDRM) reduces the cost and consequences of disasters. On the macro level, economies with deep insurance and financial markets recover faster (Pollner, 2012). Moreover, uninsured losses have been shown to drive the economic cost of disasters (Von Peter, von Dahlen, and Saxena, 2012). As we have highlighted in a previous post, the most vulnerable are least likely to be insured. Low insurance penetration coupled with high vulnerability stunts economic activity and reduces resilience to disaster shocks.

Disaster risk alters investment and production decisions and leads to higher cost of both equity and debt capital. In the absence of suitable risk management alternatives:

- Small and medium enterprises (SMEs) engage in low risk, low return strategies;

- Lenders ration credit in vulnerable regions and economic sectors;

- Some firms simply chose not to locate in vulnerable regions;

- International investors limit the supply of capital to vulnerable regions and sectors.

Consequently, many investments are not funded or those that are funded are more likely to be undercapitalized when disaster risks are present. This dynamic has profound implications for development and poverty alleviation.

Traditional insurance markets (e.g., property insurance, agricultural insurance) have limited reach in low income and emerging economies due to a long list of market and structural failures. Technological and capital market advancements create new opportunities for FDRM innovations that are better suited for conditions prevalent in lower income countries. However, commercial providers of these products (i.e., insurers and reinsurers) are reluctant to focus on lower income countries due to free rider problems, uncertainty about market potential, legal and other barriers. Consequently, innovations in FDRM are largely financed through donor interventions. Yet, donor intervention in this space thus far has not scaled largely because limited pilot projects do not address these barriers and market failures. Efforts to extend index insurance to vulnerable regions, for example, have met with limited success because:

• Risk assessment and product pricing is difficult in data sparse environments and insurers and reinsurers respond to this uncertainty by pricing products too high;

• Legal and regulatory frameworks are typically underdeveloped and institutional capacity for supervising these products is deficient;

• Clients require extensive capacity building to fully appreciate the value of insurance; and the list goes on.

In the next post, we will examine the effect of disaster risk on financial inclusiveness of SMEs and implications for economic growth and resilience building.

References:

Pollner, J. D. “Financial and Fiscal Instruments for Catastrophe Risk Management: Addressing Losses From Flood Hazards In Central Europe.” A World Bank Study 70911, The World Bank, Washington, DC, DOI: 10.1596/978-0-8213-9579-0, January, 2012.

von Peter, G., S. parental locks von Dahlen, and S. C. Saxena. “Unmitigated Disasters? New Evidence on the Macroeconomic Cost of Natural Catastrophes.” Working Papers 394, Bank for International Settlements (BIS), Basel, Switzerland, December, 2012.

Continue Reading | Comments Off on Why Is Financial Protection Important And Why Is It Not Reaching Lower Income Countries?

Combining Weather Forecasts with Catastrophe Cover to Save Lives and Foster Resilience

On Sunday, November 17, intense thunderstorms and tornadoes swept throughout the Midwest. Hardest hit was the county of Washington, Ill, that was ravaged by a tornado measuring the second highest on the intensity scale (EF-4). Over 500 homes were destroyed in Washington County alone. Thankfully, however, the fatality rate has been surprisingly low in the face of this level of devastation. Officials attribute low death toll to accurate forecasts that fed into early warning systems.

On Sunday, November 17, intense thunderstorms and tornadoes swept throughout the Midwest. Hardest hit was the county of Washington, Ill, that was ravaged by a tornado measuring the second highest on the intensity scale (EF-4). Over 500 homes were destroyed in Washington County alone. Thankfully, however, the fatality rate has been surprisingly low in the face of this level of devastation. Officials attribute low death toll to accurate forecasts that fed into early warning systems.

According to The Washington Post: “When a cluster of violent thunderstorms began marching across the Midwest, forecasters were able to draw a bright line on a map showing where the worst of the weather would go.

Their uncannily accurate predictions — combined with television and radio warnings, text-message alerts and storm sirens — almost certainly saved lives as rare late-season tornadoes dropped out of a dark autumn sky. Although the storms howled through 12 states and flattened entire neighborhoods within a matter of minutes, the number of dead stood at just eight.”

Weather predictions are getting more accurate not only in the US, but across the globe. As we noted in the previous post: “The UK Met Office uses more than 10 million weather observations a day, an advanced atmospheric model and a high performance supercomputer to create some of the world’s most accurate forecasts. These forecasts can be used to model climate risks in Africa, Asia, South America and other regions where traditional insurance markets have failed to flourish. Climate models, in turn, can feed into the design of potent financial disaster risk management products.”

Financial protection is an important piece of the risk management puzzle, because it provides resources for emergency needs and later for rebuilding livelihoods (inventory, assets, physical infrastructure, etc.) and rebounding from the disaster. Thus, a critical aspect of catastrophe cover is timeliness. Index or parametric insurance possess this critical feature. Moreover, this type of catastrophe cover can be designed for entities that serve individuals in need, such as microfinance institutions (for emergency lending) and nongovernmental organizations (for mounting emergency response).

Forecast insurance, a special type of index insurance, embodies perhaps the greatest synergy between catastrophe cover and early warning information. Forecast insurance provides policyholders with resources to begin emergency preparations in advance of the shock (e.g., shoring up infrastructure, cleaning drainage systems, elevating food stocks, etc.) that actually reduce the toll of the disaster. Scaling markets for forecast insurance may also provide a catalyst for enhancing the use of forecast information, which in turn could lead to improved adaptive strategies to climate change. GlobalAgRisk has developed a forecast insurance product against extreme El Niño in Peru, known as EENIP. To read more, please visit the Peru Project Page.

Continue Reading | Comments Off on Combining Weather Forecasts with Catastrophe Cover to Save Lives and Foster Resilience

How can Innovation in Risk Transfer Reach the most Vulnerable?

The typhoon-ravaged Philippines are a powerful reminder of the high toll of disaster risk. Vulnerability to climate shocks and natural disasters in general continues to grow, particularly among the least equipped to withstand and rebound from this risk. The graphic below paints a telling picture. The first map is a Climate Demography Vulnerability Index (CDVI), developed by Sampson, et al. (2011); the second gives an overview of property insurance penetration. High vulnerability plus the lack of financial protection means even slower economic growth and more poverty in the future.

The good news is we have the technological and scientific wherewithal to model disaster risks which can significantly improve capacity to manage them. For example, the UK Met Office uses more than 10 million weather observations a day, an advanced atmospheric model and a high performance supercomputer to create some of the world’s most accurate forecasts. These forecasts can be used to model climate risks in Africa, Asia, South America and other regions where traditional insurance markets have failed to flourish. Climate models, in turn, can feed into the design of potent financial disaster risk management products.

We have capacity in the international risk markets to hold this growing risk. For example, the reinsurance industry capital now stands at USD 510 billion. According to Aon Benfield, insurers and reinsurers will benefit from additional USD 100 billion of alternative capital in the next five years.

Lastly, we have the goodwill to find working solutions. Development organizations have entrusted millions of dollars with practitioners, such as us, to test the potential of financial innovation in fighting poverty and building resilience at scale. The parts are there. How can we unlock this existing potential to deepen risk transfer markets in lower income countries?

Continue Reading | Comments Off on How can Innovation in Risk Transfer Reach the most Vulnerable?