Dr. Skees in The Economist

Dr. Jerry Skees was interviewed for “Hard Sell: New research suggests insurance can be made more attractive for poor farmers”, which appears in the January 4th edition of The Economist. The article highlights our work on alternative indexes in Mongolia and Peru, designed to improve weather risk management and increase take-up.

Continue Reading | Comments Off on Dr. Skees in The Economist

Why Is Financial Protection Important And Why Is It Not Reaching Lower Income Countries?

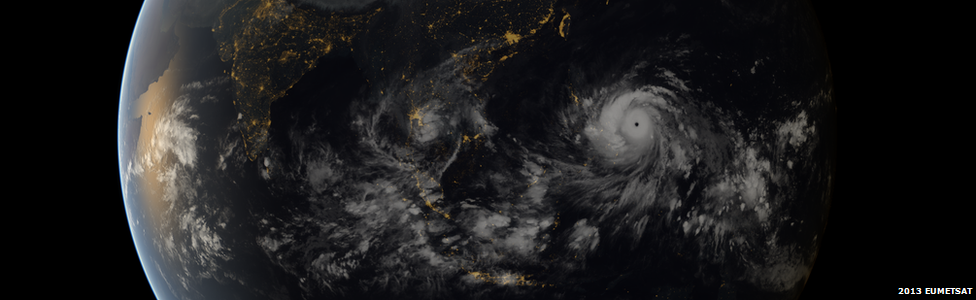

Super Typhoon Haiyan satellite image.

Droughts, floods, heat waves, and tropical cyclones are on the rise. According to the UK Met Office, climate related hazards affected over 220 million people on average every year in the period 2000-2009. Extreme events destroy livelihoods and undermine the capacity of communities to adapt to even moderate shocks.

Financial disaster risk management (FDRM) reduces the cost and consequences of disasters. On the macro level, economies with deep insurance and financial markets recover faster (Pollner, 2012). Moreover, uninsured losses have been shown to drive the economic cost of disasters (Von Peter, von Dahlen, and Saxena, 2012). As we have highlighted in a previous post, the most vulnerable are least likely to be insured. Low insurance penetration coupled with high vulnerability stunts economic activity and reduces resilience to disaster shocks.

Disaster risk alters investment and production decisions and leads to higher cost of both equity and debt capital. In the absence of suitable risk management alternatives:

- Small and medium enterprises (SMEs) engage in low risk, low return strategies;

- Lenders ration credit in vulnerable regions and economic sectors;

- Some firms simply chose not to locate in vulnerable regions;

- International investors limit the supply of capital to vulnerable regions and sectors.

Consequently, many investments are not funded or those that are funded are more likely to be undercapitalized when disaster risks are present. This dynamic has profound implications for development and poverty alleviation.

Traditional insurance markets (e.g., property insurance, agricultural insurance) have limited reach in low income and emerging economies due to a long list of market and structural failures. Technological and capital market advancements create new opportunities for FDRM innovations that are better suited for conditions prevalent in lower income countries. However, commercial providers of these products (i.e., insurers and reinsurers) are reluctant to focus on lower income countries due to free rider problems, uncertainty about market potential, legal and other barriers. Consequently, innovations in FDRM are largely financed through donor interventions. Yet, donor intervention in this space thus far has not scaled largely because limited pilot projects do not address these barriers and market failures. Efforts to extend index insurance to vulnerable regions, for example, have met with limited success because:

• Risk assessment and product pricing is difficult in data sparse environments and insurers and reinsurers respond to this uncertainty by pricing products too high;

• Legal and regulatory frameworks are typically underdeveloped and institutional capacity for supervising these products is deficient;

• Clients require extensive capacity building to fully appreciate the value of insurance; and the list goes on.

In the next post, we will examine the effect of disaster risk on financial inclusiveness of SMEs and implications for economic growth and resilience building.

References:

Pollner, J. D. “Financial and Fiscal Instruments for Catastrophe Risk Management: Addressing Losses From Flood Hazards In Central Europe.” A World Bank Study 70911, The World Bank, Washington, DC, DOI: 10.1596/978-0-8213-9579-0, January, 2012.

von Peter, G., S. parental locks von Dahlen, and S. C. Saxena. “Unmitigated Disasters? New Evidence on the Macroeconomic Cost of Natural Catastrophes.” Working Papers 394, Bank for International Settlements (BIS), Basel, Switzerland, December, 2012.

Continue Reading | Comments Off on Why Is Financial Protection Important And Why Is It Not Reaching Lower Income Countries?