Author Archive

How can Innovation in Risk Transfer Reach the most Vulnerable?

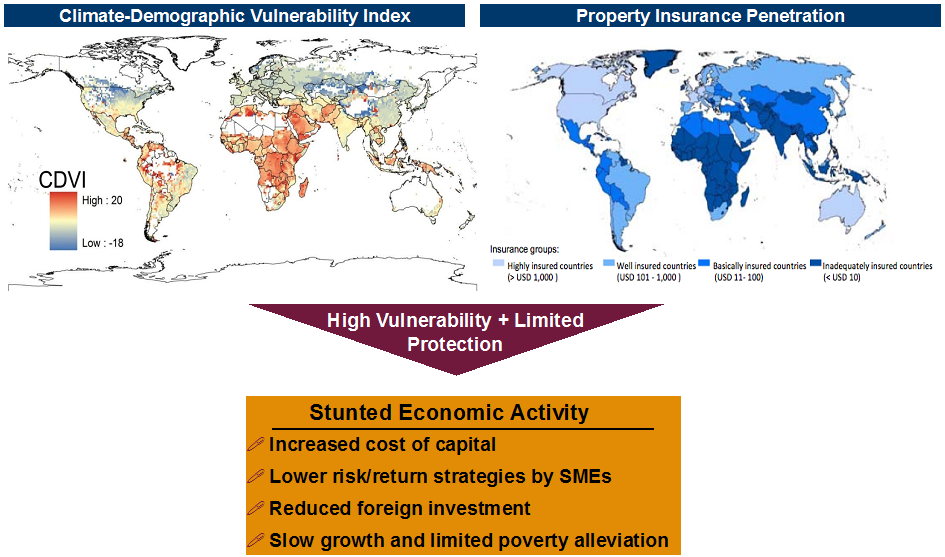

The typhoon-ravaged Philippines are a powerful reminder of the high toll of disaster risk. Vulnerability to climate shocks and natural disasters in general continues to grow, particularly among the least equipped to withstand and rebound from this risk. The graphic below paints a telling picture. The first map is a Climate Demography Vulnerability Index (CDVI), developed by Sampson, et al. (2011); the second gives an overview of property insurance penetration. High vulnerability plus the lack of financial protection means even slower economic growth and more poverty in the future.

The good news is we have the technological and scientific wherewithal to model disaster risks which can significantly improve capacity to manage them. For example, the UK Met Office uses more than 10 million weather observations a day, an advanced atmospheric model and a high performance supercomputer to create some of the world’s most accurate forecasts. These forecasts can be used to model climate risks in Africa, Asia, South America and other regions where traditional insurance markets have failed to flourish. Climate models, in turn, can feed into the design of potent financial disaster risk management products.

We have capacity in the international risk markets to hold this growing risk. For example, the reinsurance industry capital now stands at USD 510 billion. According to Aon Benfield, insurers and reinsurers will benefit from additional USD 100 billion of alternative capital in the next five years.

Lastly, we have the goodwill to find working solutions. Development organizations have entrusted millions of dollars with practitioners, such as us, to test the potential of financial innovation in fighting poverty and building resilience at scale. The parts are there. How can we unlock this existing potential to deepen risk transfer markets in lower income countries?

Continue Reading | Comments Off on How can Innovation in Risk Transfer Reach the most Vulnerable?

Portfolio Protection against Earthquake Disaster

GlobalAgRisk, in collaboration with PT. Asuransi MAIPARK Indonesia and Aon Benfield Asia Pacific, is developing index-based earthquake insurance in Indonesia to strengthen the resiliency of the financial sector that serves lower income households and small and medium enterprises. Earthquakes can have profound impacts on bank operations, depleting the bank’s capital base, reducing liquidity, and lowering profits. The product called “EQII,” or “Earthquake Index Insurance,” is designed to transfer portfolio risks of financial institutions, enabling them to expand access to financial services in vulnerable, under-served areas and to aid in local recovery through continued lending after an earthquake event.

GlobalAgRisk, in collaboration with PT. Asuransi MAIPARK Indonesia and Aon Benfield Asia Pacific, is developing index-based earthquake insurance in Indonesia to strengthen the resiliency of the financial sector that serves lower income households and small and medium enterprises. Earthquakes can have profound impacts on bank operations, depleting the bank’s capital base, reducing liquidity, and lowering profits. The product called “EQII,” or “Earthquake Index Insurance,” is designed to transfer portfolio risks of financial institutions, enabling them to expand access to financial services in vulnerable, under-served areas and to aid in local recovery through continued lending after an earthquake event.

This project builds on innovation in northern Peru, where the threat of extreme El Niño significantly constrains the provision of financial services to the poor. As of 2011, banks can purchase index-based portfolio insurance that uses measures of sea surface temperatures as the basis for payouts. Designed by GlobalAgRisk, the Extreme El Niño Insurance Product (EENIP) is the world’s first “forecast’ insurance coverage, providing payments even before the arrival of catastrophic flooding. A top-ranked microfinance institution purchased EENIP in 2011 and 2012. The market development progress in Peru has stimulated a great deal of interest among development finance institutions, the reinsurance industry, and neighboring countries to explore opportunities for adapting and replicating this important model of ex ante disaster risk financing (click here to read the EENIP press release).

Indonesia’s financial sector faces one of the highest earthquake exposures in the world. This exposure is perhaps most evident on financial institutions that have limited opportunities to diversify geographically. Localized institutions dominate Indonesia’s financial landscape and have the greatest outreach to small and medium enterprises — the country’s economic engine. Therefore, helping financial institutions to better manage earthquake risk has important economic implications, contributing to the goals of development and poverty alleviation.

When many borrowers suffer losses at the same time, geographically concentrated institutions such as rural banks and microfinance lenders simultaneously experience sharp spikes in bad loans, deposit withdrawals, and falling revenues. The ensuing capital and liquidity problems can lead to insolvency of some institutions, while those who survive struggle to regain profitability many years after the event. Without significant recapitalization, banks are forced to stop lending precisely when the community is in greatest need of resources for recovery and rebuilding, which also represents a significant lost opportunity to generate new income.

A recent Asian Development Bank (ADB) report highlights the importance of natural disaster risk financing solutions for the Asia-Pacific region in strengthening its disaster resilience. The report finds that risk financing instruments, including disaster insurance, are key to building the region’s resilience against disaster and reversing the erosion of Asia’s economic resources. The consequences of unmanaged earthquake risk on Indonesia’s banking system epitomize this erosion. In the absence of disaster risk financing, banks cope by curtailing lending to vulnerable clients, raising interest rates, and maintaining high capital reserves to absorb shocks. These strategies are inefficient from a business standpoint and highly undesirable from a development perspective.

Disaster risk insurance is an important piece of any comprehensive disaster risk management strategy. Using EQII to help financial institutions become more resilient to earthquake risk should lead to 1) lower interest rates; 2) greater financial inclusion; 3) stronger financial institutions after an earthquake; and 4) increase in post-disaster lending. This protection can strengthen the social mission of financial institutions that serve the poor, near-poor, and small and medium enterprises, while also helping them grow and thus maintain their obligation to shareholders.

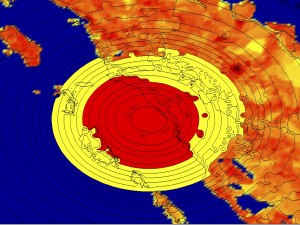

The mechanism for EQII is based on an intensity index of earthquake-induced ground motion that is mapped geographically. This information is calibrated to the financial institution’s expectation of loan non-performance across its portfolio in order to obtain the payment levels of the product.

EQII protection purchased by localized institutions makes them a better client to second-tier institutions that provide long term capital for on-lending. Since highly exposed localized institutions may have difficulties servicing their debt obligations following an earthquake shock, EQII provides an important additional level of protection to these secondary lenders. Because EQII is a new product, GlobalAgRisk is working with regional development and apex banks to purchase an umbrella or “master policy” on behalf of primary lenders. Such master policies will have re/insurance pricing advantages and represent an auspicious starting point for the market development process. If an earthquake triggers the index, insurance payments would be made directly to the local banks — the primary beneficiaries — who would be contractually obligated to use the payment solely as a capital injection. These local lenders may wish to purchase additional coverage that meets their needs given the earthquake risk exposure of their lending portfolio.

Unmanaged natural disaster risk limits growth and imposes costs at each stage of the banking system. Second-tier banks limit lending to exposed primary institutions, while these local lenders ration credit to vulnerable small and medium enterprises that represent the backbone of Indonesia’s economy. A widespread use of natural disaster financing solutions such as EQII has the potential to strengthen the entire financial system in Indonesia, while expanding the reach of financial services to the more vulnerable segments of society.

Click here to read “Strengthening Financial Institution Resilience to Earthquake Risk in Indonesia: The Role of Index Based Portfolio Insurance”

Click here to read “Portfolio Protection against Earthquake Disaster for Second-Tier Financial Institutions in Indonesia”

Intensity Map on Population Grid for

M=7.5 Sumatra earthquake on Sep 30, 2009

Continue Reading | Comments Off on Portfolio Protection against Earthquake Disaster

IDB Conference on Risk Management in Agricultural Finance: Building More Inclusive and Secure Markets

The September 24, 2012 Inter-American Development Bank conference on Risk Management in Agricultural Finance examined new approaches for managing agricultural risks that help expand access to finance while lowering rural poverty and improving food security in Latin America and the Caribbean. The focus was on market-based approaches that address pervasive price and output risks in agriculture. Experts discussed the challenge facing policymakers and practitioners as they seek successful innovations that are sustainable and scalable. The conference highlighted case studies of products and institutions that are considered to be at the cutting edge and have already demonstrated effective results.

The September 24, 2012 Inter-American Development Bank conference on Risk Management in Agricultural Finance examined new approaches for managing agricultural risks that help expand access to finance while lowering rural poverty and improving food security in Latin America and the Caribbean. The focus was on market-based approaches that address pervasive price and output risks in agriculture. Experts discussed the challenge facing policymakers and practitioners as they seek successful innovations that are sustainable and scalable. The conference highlighted case studies of products and institutions that are considered to be at the cutting edge and have already demonstrated effective results.

Dr. Jerry Skees presented on Creating a Regional Platform for Risk Management in LAC. Viewed form the regional perspective, there are many opportunities to diversify and transfer risks. The approach proposed is for a market based facility to manage regional risks through use of reserves, access to contingent credit, futures exchange markets, and recent innovations in risk pooling for natural disasters. Economies of scale and scope are needed for a Regional Platform to be effective with adequate capitalization and a capacity to manage a diverse portfolio of risks.

Click here to download the presentation.

Benjamin collier presented on Financial Inclusion and Pro tecting Bank Portfolios from Natural Disaster Risks. Sustainable financial inclusion is significantly challenged by the presence of systemic risks such as natural disasters and commodity price volatility. In general, financial institutions are poorly equipped to manage these systemic risks under current public and private sector standards. Systemic events create losses, erode capital and compromise their ability to lend. As a result, financial institutions limit their financing for vulnerable households and firms. Portfolio-level insurance against disasters can improve management of these events. The case of insurance against exposure to severe El Niño effects in Peru will be presented, showing how this product allows lenders to manage this risk more efficiently and effectively, translating into better financial performance, expansion of banking service outreach, lower interest rates, and reduced volatility in access to credit.

tecting Bank Portfolios from Natural Disaster Risks. Sustainable financial inclusion is significantly challenged by the presence of systemic risks such as natural disasters and commodity price volatility. In general, financial institutions are poorly equipped to manage these systemic risks under current public and private sector standards. Systemic events create losses, erode capital and compromise their ability to lend. As a result, financial institutions limit their financing for vulnerable households and firms. Portfolio-level insurance against disasters can improve management of these events. The case of insurance against exposure to severe El Niño effects in Peru will be presented, showing how this product allows lenders to manage this risk more efficiently and effectively, translating into better financial performance, expansion of banking service outreach, lower interest rates, and reduced volatility in access to credit.

Click here to download the presentation.

Richard Carpenter presented on Barriers to Product and Institutional Innovations. What is the appropriate legal and regulatory setting to support new innovations in insurance and derivatives? What are the needed upgrades to banking regulation and supervision? Based on experiences in various countries, the presentation identifies what are the main “gaps” found in emerging market economies that inhibit the use of state-of-the-art financial instruments. Also discussed are lessons regarding how to overcome these barriers.

Click here to download the presentation.

Continue Reading | Comments Off on IDB Conference on Risk Management in Agricultural Finance: Building More Inclusive and Secure Markets